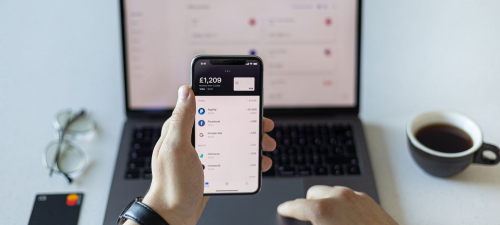

Revolut celebrates the new partnership with monday.com and presents 5 budgeting tips for the small business owner.

There are definitely many difficulties when you try to manage a small business but usually, economy management comes on the top of the list.

Below you can find some simple and helpful tips.

1. Keep separate business and personal expenses

There are numerous reasons not to mix your business and personal accounts, such as tax issues, personal liability, auditing issues, and jumbled accounting entries. This will help you avoid a mess that it is usually difficult to clear. Adhere to a business and a personal budget separately. Do not use business credit cards or loans for personal finances. When the time comes to pay your taxes and manage your books you will be really grateful

2. Track Your Expenses

It is very significant to understand who are the most profitable clients and areas. Watch your money as it flows in and goes out and spend your hard-earned funds wisely. This information will help not to invest too much on projects that won’t give the ROI you need. Also, be careful of hidden charges and fees could hurt your business. Monday.com provides a platform that you can monitor your income and expenses. With their planning board, you can monitor you can note down every activity your business will engage.

3. Plan the future

Try not to underestimating or overestimating your budget because you could eventually run out of money.

Make a plan for future expenses and try to find ways to save some money. You’ll need to account for major processes, like staff recruitment, and minor aspects since they could gradually add up to something your business won’t handle. Planning the future will help you manage your budget as effectively as possible.

4. Settle your bills without delay.

Paying your bills on time is a tough, but essential skill to learn. Knowing when your bills are due and making a habit of paying them on time. Credit card fees and late loan payments could cost you a lot. If you use the monday.com budget planning board, you have the option to add in a few automation like due date reminders for all your bills. For any small business avoiding late fees could make a difference.

5. Review your budget often

The budget on a small business often changes, so you will need to adjust it. Checking on your budget can help you to monitor it and keep you from overspending. If you understand your business finances, you will be prepared to make good money management decisions. And while the tips above will get you going, nothing can replace being hands-on and proactive when managing your business’ finances.