Insights, Highlights and more

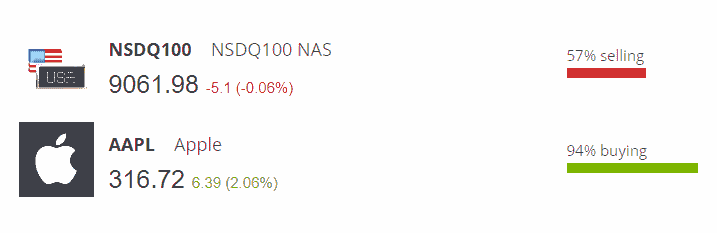

The US markets closed higher on Monday, resuming the rally that started last week amid increasing optimism of a US-China trade agreement set to be signed tomorrow (Wednesday). The NSDQ100 and SPX500 both notched new all-time highs, gaining 1% and 0.7% respectively. Apple shares also rose 2.1% to hit a new record. Goldman Sachs and Cisco Systems rose more than 1% each to lead the DJ30 0.3% higher.

Today’s highlights: Tesla and Beyond Meat shares surge, Crypto still going strong

Crypto rally continues: Bitcoin continues to climb, reaching over $8,400 and taking most of the crypto market along for the rally. Dash soared by as much as 10% over the last 24 hours alone, surging over 50% in the past week.

Asian markets mixed: Many Asian shares gained Tuesday amid optimism for the upcoming phase one of a US-China trade deal, but indices still show mixed sentiment. JPN225 was up 0.8%, but China50 and HKG50 dropped -0.35% and -0.2% respectively.

GBP falls below $1.30: The GBP fell by around 0.7% against both the USD and the EUR after Bank of England (BOE) Monetary Policy Committee (MPC) member Gertjan Vlieghe hinted at a possible cut in interest rates.

Beyond Meat jumps 10.4%: BYND shares rose 30% amid a three-day winning streak, soaring 42% in a week.

Tesla shares pop 9.7%: TSLA shares jumped following an analyst price hike. The stock broke above $500 for the first time ever.

Volatility expected for USD: The US Labor Department releases data on consumer-price growth in December at 13:30 GMT, potentially impacting the US Dollar.

Oil rises slightly: The black gold prices edged a bit higher to $58.21, a tentative rebound as Mid-East tensions seem to be calming.

Europe opens mixed: The UK100 opened 0.25% higher, with Pennon Group shares jumping 6% and Tullow Oil climbing 5.8%. The GER30 was up 0.21% and the FRA40 opened -0.16% lower.

* Cryptoassets are a highly volatile unregulated investment product. No EU investor protection. Your capital is at risk.

* Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

* The information above is not investment advice.